What Is The Section 179 Tax Deduction For Cadillac Vehicles?

When you're running a business that can use heavier SUVs and vehicles, knowing the ins and outs of the Section 179 tax deduction can get you a lot of benefits. This rule lets you deduct 100% of a work model's cost from your income over the course of its life, and recent policy allows for even faster ways to get your expenses taken out of your taxes. Plus, here at Paul Conte Cadillac in Freeport, NY, we have available models that could be eligible for the Section 179 tax credit.

If you have questions or need more details, we're here to clarify the terminology and explain what you'll actually receive from this legislation.

What Is the Section 179 Tax Deduction?

The Section 179 tax deduction (vehicles above 6,000 pounds GCWR) is a business-oriented benefit for small and large companies wanting to purchase a car, truck, or SUV. Depending on your purchase, you can deduct up to 100% of the purchase price of your vehicle from your taxable income, reducing what you have to pay next season. This benefit also extends to passenger options (like the ones in our new Cadillac vehicles), though they typically receive more limited benefits.

What Qualifies for a Section 179 Tax Deduction?

However, in order to get the full Cadillac tax deduction through Section 179, you need to follow a few rules:

- The Gross Vehicle Weight Rating (GVWR) of your model is above 6,000 pounds and below 14,000 pounds.

- The truck or SUV is used for for business purposes more than 50% of the time, with the logs to prove it.

- It is not used specifically for passenger or commuting purposes. Passenger models receive a separate deduction with a limit between $12,200 and $31,300, depending on the body style and bonus depreciation.

If you want to purchase a Cadillac SUV for work purposes that doesn't fall under these categories, you can still benefit from a deduction. For more information on the limitations that a smaller Cadillac model can deduct from your business's income, please contact your tax expert or our financing department.

How Does a Cadillac LYRIQ Section 179 Deduction Work?

While deductions are fantastic for your business, a Section 179 Cadillac write-off requires careful planning and the right forms. Section 179 of the IRS tax code allows you to take up to 100% of the depreciable cost of a vehicle and remove that from your taxable income (up to $2,500,000) once you have proven that it follows all the requirements.

So, for example, say you purchase a Cadillac Escalade and use it exclusively for business purposes, leaving it at the worksite's garage and everything. If you put it into action before December 31st, 2025, for the next tax season, you may choose to remove the full price of the vehicle from your taxable income with the help of the Section 179 form. Documents to keep close at hand include:

- Purchase/lease invoice

- Proof of payment

- In-service dates (including dates of installation of add-ons or software)

- Business usage logs

- Form 4562 filing documentation

For more information on the differences between a write-off and a deduction, as well as what benefits can be expected from the various vehicles on our lot, please talk with our financing department near Bay Shore, NY, and your business's tax professional.

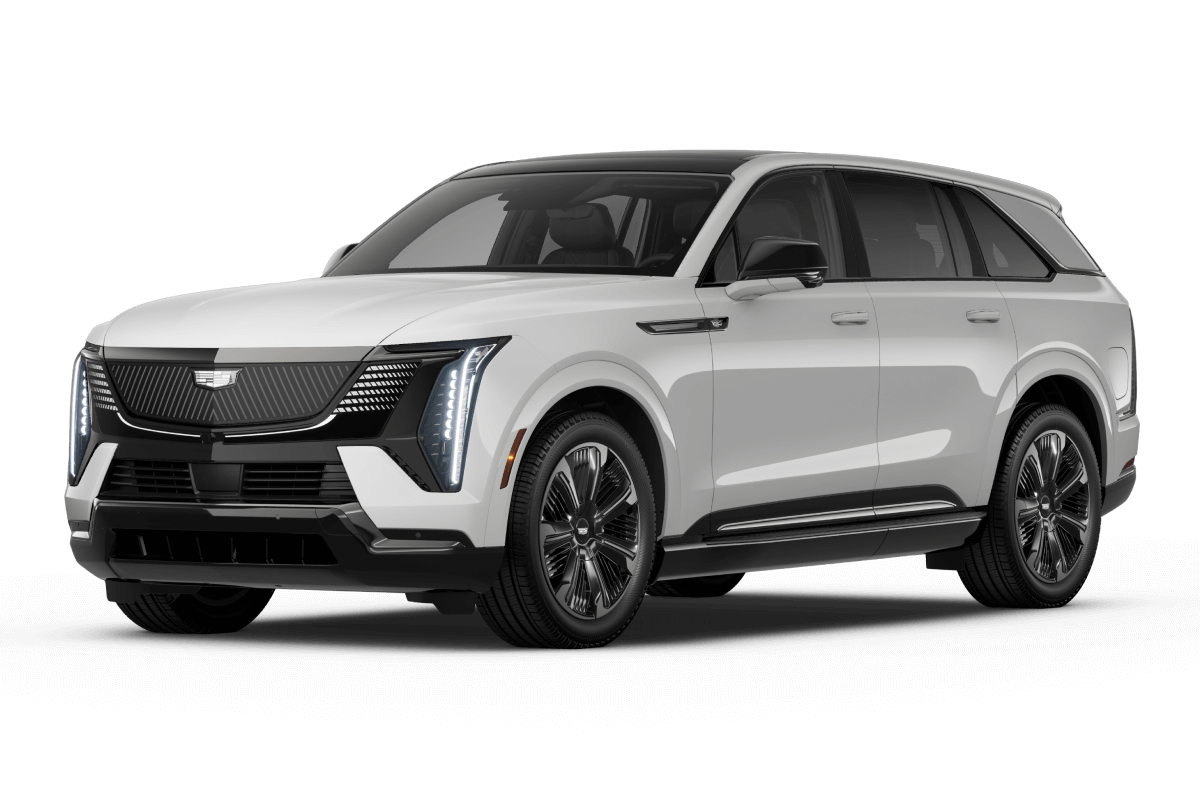

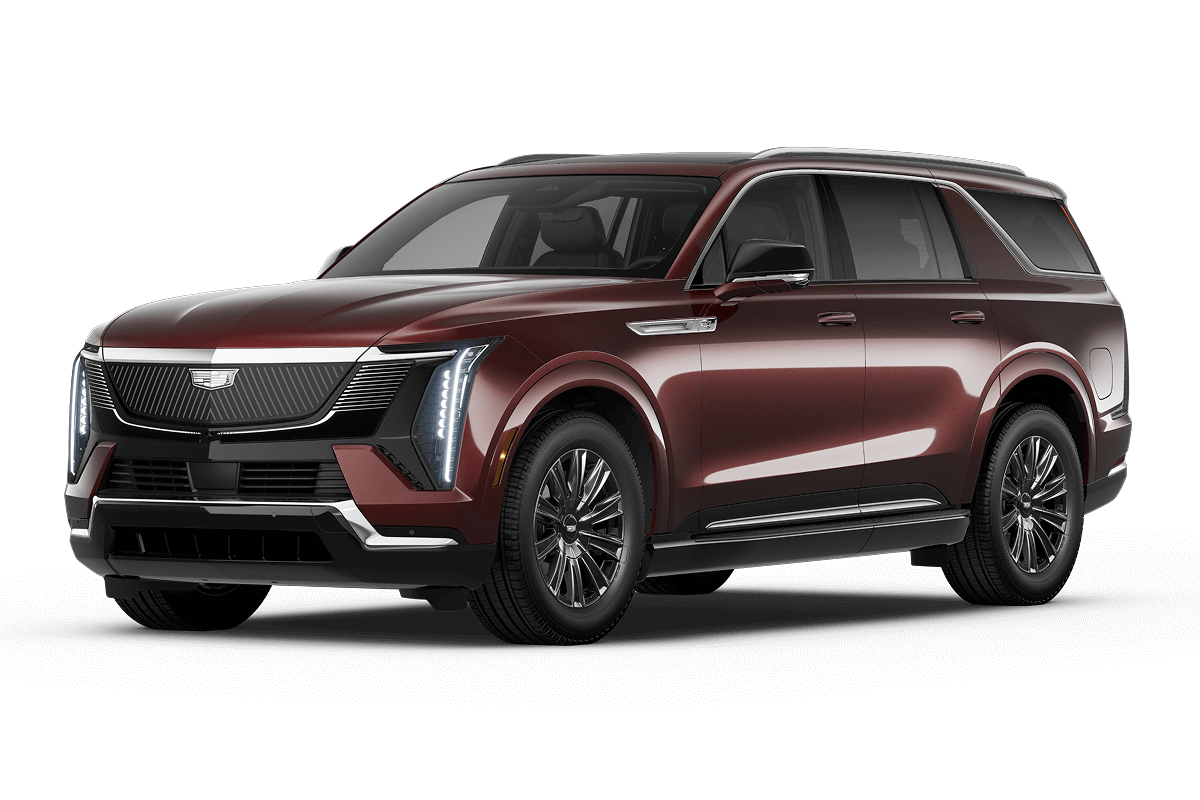

Cadillac Vehicles Eligible for Section 179 Benefits

Say that you're looking for Cadillac tax write-off opportunities for your business, and you come across our inventory of Cadillac LYRIQ models. A 2025 LYRIQ can qualify for increased benefits if you receive the right trim package and use it primarily for business purposes.

What other models will qualify and turn your business into a luxurious haven? Here are some of the SUVs that may qualify for 100% deduction status, and the sedans that can be used for partial credit for $20,200 off your taxable income.

Take Advantage of the Section 179 Tax Deduction at Paul Conte Cadillac

Whether you're looking for an opportunity to get an Escalade tax write-off or want to make the best use out of a company deduction, our team near Farmingdale, NY, is here to lend a hand. We'll give you an extensive tour of any model that you have your eye on. Our financing experts can explain which of our vehicles qualify for a full Section 179 tax deduction and which are likely to be subject to a limit.

Then what if you need a trustworthy dealership to maintain your business's investment near Smithtown, NY? At Paul Conte Cadillac, you'll have access to an extensive, state-of-the-art facility with factory-made parts and certified technicians specializing in Cadillac cars and SUVs.

What Our Happy Customers Say About Our Cadillac Vehicles

Federal tax benefits are available for vehicles acquired for use in the active conduct of trade or business and may change or be eliminated at any time without notice and each taxpayer's tax situation is unique; therefore, please consult your tax professional to confirm available vehicle depreciation deductions and tax benefits. For more information, visit www.irs.gov. This advertisement is for informational purposes only, and should not be construed as tax advice, or as a promise of availability or amount of any potential tax benefit or reduced tax liability.